28 May 2020 / The experts of the Vitagora ecosystem / Vitagora publication / Markets and trends

How to get a handle on the French food-service sector

This article is also available in French:

In 2017, the European food-service industry was valued at €335.9 billion. The food-service industry includes all meals prepared outside the home, whether it be in canteens, planes, bakeries, Michelin-starred restaurants, cinemas, fast-food outlets or bowling alleys. The food-service sector offers a wide range of opportunities for food businesses wanting to crack the BtoBtoC market. What is the food-service market? Who are the main players? What do they need and how can we serve them? What is the best way to approach food-service companies? Florence Vachey and Jérémy Correia, Directors and Consultants at JPM Partner, shed some light on the subject.

Why this should interest you

- Le food service est un secteur économique puissant qui offre de nombreuses opportunités de développement vers des cibles BtoBtoC.

- The food-service industry is a powerful economic sector that offers opportunities for development with BtoBtoC targets.

- It can also be a good platform for highlighting the innovative aspects, whether they be in terms of products or packaging.

- The sheer quantity of food-service businesses provides a vast opportunity for your product sales.

- Food-service businesses are looking for products with purpose (local, organic, 'clean', etc.) that are easy to use (convenient packaging, ingredients, etc.) but which also enhance a dish with an original ingredient or a new flavour for example.

- Fall-out from the CoVID-19 pandemic is likely to reshuffle the cards in the food-service market and offer new opportunities.

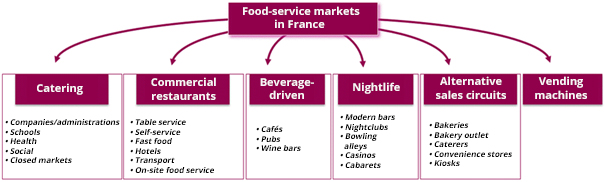

Commercial flights, high-speed rail, bakeries, restaurants, cinema, fast-food outlets, bowling alleys… At a glance they all very different, but they have something in common: they all serve food on site or to take away. The food-service market is driven by a value chain, from SMEs to large companies, from distributors to restaurants. It is organised in market segments which have their own codes and uses. They include institutional catering for school canteens, corporate restaurants, and commercial catering with a myriad of fragmented market structures.

In recent years, the diversification of the food range (sushi, poke bowl, tacos, etc.), the increase in opportunities for eating out (brunch, after-work activities, etc.), and the development of delivery apps such as Deliveroo or Uber Eats have boosted the growth of the food-service sector (source : LSA).

In 2017, 1 in 5 meals were eaten outside of the home in Europe. That’s nearly 48.5 billion meals or snacks. It is also a market of €335.9 billion (source: IRI).

The lockdown since March 2020 due to the Coronavirus pandemic has had direct consequences on French food services. Overall, the market is still growing and offers many opportunities for the food industry. But it is also a market with very specific expectations that can be difficult to penetrate.

Who are the main players in this market? What do they need and how can we meet their needs? What’s the best way to approach them, to attract their attention, and finally, to succeed in getting access to the food-service market?

Florence Vachey and Jérémy Correia, Directors and Consultants at JPM Partner shed some light on the subject. They give us feedback from their missions helping food-industry businesses penetrate the food-service sector.

Florence Vachey and Jérémy Correia

With a Master’s in Marketing & Management and currently strategic planner for JPM Partner, Florence Vachey has made the brand her specialty, taking it from creation through to development. In charge of key accounts, she had the opportunity to set up a department dedicated to marketing and communication for the food-service sector in 2004. The first mission was to assist with the creation of Unilever Food Solutions. The specialist department continued to develop, with more consulting missions and operational projects for Yoplait Restauration, Sodiaal, Daucy Foodservice, Bel Foodservice, Cerelia, etc.

With a Master’s in Marketing & Management and currently strategic planner for JPM Partner, Florence Vachey has made the brand her specialty, taking it from creation through to development. In charge of key accounts, she had the opportunity to set up a department dedicated to marketing and communication for the food-service sector in 2004. The first mission was to assist with the creation of Unilever Food Solutions. The specialist department continued to develop, with more consulting missions and operational projects for Yoplait Restauration, Sodiaal, Daucy Foodservice, Bel Foodservice, Cerelia, etc.

A graduate of ISEMA with a Master's degree in Food Industry Marketing, Jérémy Correia joined JPM Partner in 2011. Currently Director of Consulting and Strategy, he assists the agency’s clients to develop and deploy their marketing strategies. He works closely with the food industry, including clients such as Bleu Blanc Ruche, La Mémère, Reine de Dijon, La Brigade des Epices and Groupe Seb.

A graduate of ISEMA with a Master's degree in Food Industry Marketing, Jérémy Correia joined JPM Partner in 2011. Currently Director of Consulting and Strategy, he assists the agency’s clients to develop and deploy their marketing strategies. He works closely with the food industry, including clients such as Bleu Blanc Ruche, La Mémère, Reine de Dijon, La Brigade des Epices and Groupe Seb.

JPM Partner

Founded in 1984 in Dijon, JPM Partner communications agency combines development and innovation strategy consulting, a communications service, a cloud of expert partners, a creative lab and a production facility. JPM Partner helps companies and government authorities to develop their strategy and create and implement print and digital communication tools.

JPM Partner has developed sophisticated expertise in the food-service market by combining a strategic approach with physical responses. The agency’s clients include food-service greats such as Tippagral, D'Aucy, the BEL group, Unilever and Pomona.

Food service in France: what is it really?

A market with history

“The first company canteen in France was created in 1866 by Banque de France," Florence recounts. In 1897, Crédit Lyonnais launched the first subsidised company restaurant: 600 meals were served daily in two dining rooms, one for men and one for women) (source : Capital).

Since then, the food service has changed and gained structure. This market is defined as a range of eating-out options covering all aspects of quality, setting or cost of the meal. The market is vast, including school canteens, Michelin-starred restaurants and food trucks.

[Source https://www.girafood service.com/marche-restauration/structure-marche-restauration.php]

“The food-service market is an economic giant...the volume is barely imaginable. Institutional catering alone serves almost 3 billion meals each year in France,” Florence explains. That said, France is the exception in Europe because institutional catering is much more developed there. (31% of food-service revenue in France compared with an average 20% in Europe). This is largely due to social policy that has historically supported food services in businesses and educational institutions.

A complex and constantly changing market

In 2018, the French food-service market represented €87 billion divided amongst eating-out options (€76 billion] and “impulse” distribution outlets such as bakeries, convenience stores and petrol stations (€11 billion) (Source: IRI Worldwilde). The same year, France counted approximately 260,000 establishments serving eating-out options.

The food-service market includes many economic players: suppliers (mainly the food industry), distributors (Pomona, Métro, Promocash, SCAL etc.) and restaurants and kitchens (central kitchens, restaurants, airports, bakeries, etc.). "It’s a fascinating market. It is a whole section of the economy - a world unto itself with its own rules, standards and culture,” says Florence.

As a result, the rules are not the same for promoting food products to mass retailers and institutional catering companies.

What are the priorities in the food-service market?

Save time and money

Initially, the food industry simply adapted the formats and packaging of their retail products to meet a professional target. But the food-service sector now expects added value that differentiates products. Food products must have benefits for the chef including adapted volumes, convenient packaging, ease-of-use, hygiene standards, attractive price, etc.

"First and foremost, food products must save time and money. Put yourself in the chef’s shoes. They have to produce several dishes at the same time so they need time-saving solutions that add value so they can justify their price,” says Jérémy. That said, "a lot depends on the operator and their regulations. Canteens consider price, convenience and compliance with the Egalim Act. Gastronomic brasseries look for convenience and margin with original and quality solutions.”

For example, Maille’s “two-phase” dressing range is only available to chefs and not available for retail sale with brand new recipes and a 1L bottle. JPM Partner assisted Unilever with the product launch: defining product position including brand new recipes, packaging, a launch plan and recipe book. Maille vinaigrette offers a more practical product with enhanced flavour exclusively available to the food-service sector.

Provide added value

Saving time and money is important, but it’s not that simple. Florence emphasizes the importance of the chef’s character: "Apart from Michelin-starred chefs looking for ultra-fresh, high-end products, there are two types of chefs: ‘assemblers’ and ‘creators’. ‘Assemblers’ are opportunists who need practical, quick and cost-effective solutions. ‘Creators’ look for products that enhance their dishes and menu.”

It might be an ingredient, such as a rare spice, for which the producer can be a source of interest. For example, a restaurant in Dijon could use local products such as Mulot and Petitjean gingerbread or L’Héritier-Guyot liqueurs.

Consumers are asking for more natural, local and healthy food and these trends are reflected in the food-service sector. (Source: IRI).

SIRHA is the French flagship trade show for food-service professionals. SIRHA is where innovative products are released that provide chefs of traditional and institutional restaurants with concrete solutions. In 2019, focus was on plant products to meet consumer demand for healthier food, with offeres such as Bonduelle vegetable fritters, PCB Création vegetal cocoa butters and Olmix’s 100% plant-based, additive-free texturising agent (Source: SIRHA).

There is a shift towards the same practices in the retail sector and food services. "When supermarkets launched their first branded products, they were mainly at budget price. Now, supermarket brands promote quality and origin. The ranges are being elevated to match premium standards,” Florence stresses.

What is the best way to approach the food-service sector?

Design your concept in advance

"We worked with a spice supplier on their range for professionals. Their initial position was simple: “We have the best spices in the world. Why wouldn’t chefs trust us?” But how can you prove it? How do you make chefs want to work with your spices?” Jérémy asked.

This is a reminder of the importance of offering quality solutions that generate financial gain. “We developed a range of spices with two segments: raw spices and spice mixtures. As a result, the range addresses the two different chefs: ‘creators’ and ‘assemblers’. Packaging design is premium with kraft packaging for raw spices and metal containers for spice mixtures.” Jérémy stresses the importance of working on packaging for premium products and to be sure they tell a story: "The chef must be proud of his supplier and want to communicate about them. Carefully designed packaging enhances product quality. And to take things even further, we worked on storytelling to breathe life into the products by creating “seasons.” For paprika, then curry. The idea is to develop a whole range of products around one spice (raw spices, mixtures, oils, etc.) to inspire chefs.”

Use the right media

Obviously, unlike food products intended for retail distribution, communication to the general public is irrelevant. All the traditional communication means, such as television, supermarket promotions and sample distributions, are out.

There are five main relevant communication methods:

- Professional press: paper and web such as the French magazines Neo Restauration, Le Chef, the Hotellerie Restauration etc.

- Distributor catalogues: Metro, Pomona, France Gourmet etc.

- Professional events such as SIRHA are very important because you have direct contact with your target and they can taste your products.

- Cooking competitions are ideal for product placement, not to mention you are communicating with future chefs still in training.

- Digital with increasingly active, content-fuelled professional-brand sites designed to convince their customer communities, and sometimes even e-shops that complement or even compete with distributors.

For example, to promote d’aucy Food Service’s range of omelettes, JPM Partner launched a campaign in the professional press. The original twist in this campaign is recipes proposed by institutional catering chefs. Florence explains, "The best way to promote the qualities of a product is to get professionals to talk about them. We asked institutional catering chefs to create recipes using d’aucy Food Service’s products. They threw themselves into it with great enthusiasm.”

Florence and Jérémy are unanimous: The best way to develop your activity in the food-service sector remains being listed by large distributors, both distributors with delivery services (e.g. Pomona, Transgourmet, France frais, etc.) and cash and carry (e.g. Metro, Promocash). “Featuring in the catalogue of a distribution giant is a big step in the right direction. There is room for premium and products with high added value, but distributors give priority to volume,” our specialists warn, before concluding: "There are real development opportunities for products with high added value: Made in France, regional products, 'clean', short-distribution channels, organic, etc. Distributors, like consumers, are looking for brands with purpose."

What does the future hold?

The COVID-19 pandemic almost brought the food-service sector to a halt from mid-March onwards. At the time of publication of this article, it is difficult to foresee how food services will be accessible to the general public in the future, but the business model of restaurants must be taken into consideration.

Is it necessary to reduce the number of tables? Will customers prefer traditional restaurants that use local produce? Will home deliveries increase? Will institutional catering turn to fresher, more local produce?

Florence insists on industry’s role: "Many brands will have to target their reflection at reassuring people about health and hygiene and giving their product positive impact", before concluding on a positive note, "Food and all the dimensions of eating well - quality products, sharing and festivity - is still a major concern for the French population”.

This could be a chance for members of the food industry to turn uncertainty into opportunity by rethinking their offer to the food-service sector.

Keywords

Food service, communication, packaging, market opportunities

|

Find out more...To find out more about the expertise of JPM, or the food service sector in France, contact Elodie Da Silva, Innovation & Ecosystem team leader with Vitagora: elodie.dasilva@vitagora.com.

A food engineer from the French city of Toulouse, Elodie devotes her considerable energies to leading Vitagora's team of food innovation professionals in supporting members' innovation activities. |

Further reading

- JPM-Partner website: https://jpm-partner.com/

Home

Home